Accounting Services for Businesses

£25.00 — or £25.00 Original price was: £25.00.£12.50Current price is: £12.50. / month for 12 months

If you run your own business (sole trader, partnership or limited company), you are required by law to maintain accurate accounting records for a number of years (5 years for sole traders, 6 years for a limited company). HMRC can ask at any time within the retention period for these records to double-check the figures that have been submitted for your business.

If the records are not provided within a reasonable time when requested, HMRC can impose a penalty or a higher tax bill if accurate records cannot be provided to justify income, expenses and reliefs claimed.

Our team of skilled and experienced accountants sspecialize in managing accounting and tax obligations for businesses. We will help your business to comply with requirement to maintain complete and accurate accounting records by performing the following tasks.

- Data entry

- Capture and document relevant financial transaction to generate required accounting records

- Provide expert guidance on record to maintain for tax deductions, allowances, and reliefs claimed

- Ongoing support (through telephone or zoom meetings) to ensure your business meets its regulatory reporting requirements

- Estimation of tax bill

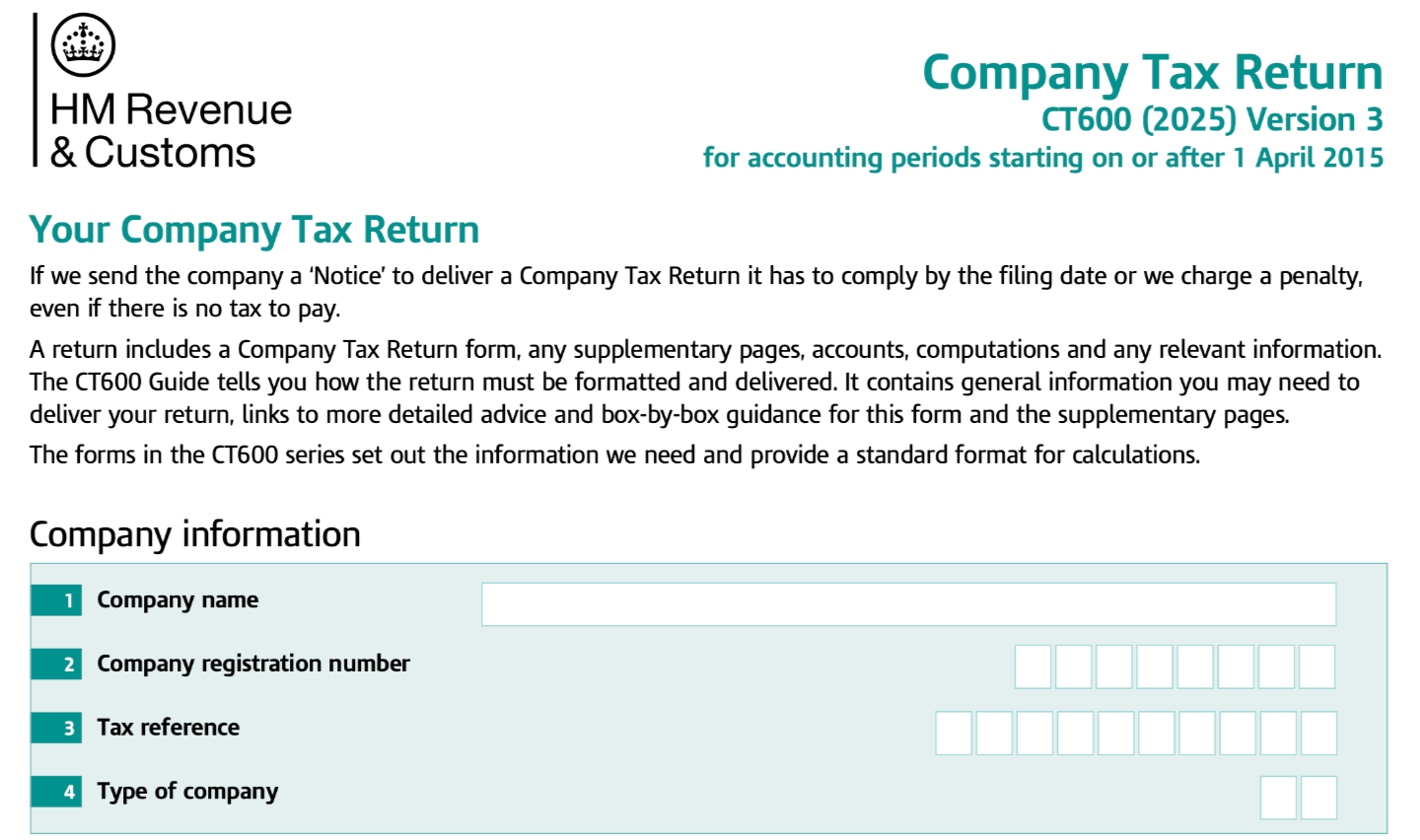

- Preparation and filing of Year End accounts with Companies House and HMRC

- Preparation and filing of tax return with HMRCBottom of Form